Anyone who knows me knows how much music is a part of my everyday life. I especially enjoy live concerts and prefer smaller venues over stadiums. I listen to a variety of genres depending on the mood I’m in or one I want to elevate to. I was struggling with a topic for this blog […]

Before you clear off your dining room table, putting away those tax documents, take this opportunity to organize your financial records. Whether you prefer a tabbed binder or a digital folder, taking the time to pull together and annually update your financial information will be beneficial in the long run. Not only will it make […]

The recent market volatility has brought the subject of behavioral finance back into focus. There are biases inherent in the human mind that affect a person’s ability to make sound decisions, whether they are related to an investment portfolio or everyday life. Over the coming quarters, I’ll be looking at a number of these biases […]

While timeshares can offer access to an exciting vacation destinations, they often lose their luster and benefits go underutilized. So, what happens when you want out? Unfortunately, timeshare contracts can be difficult to unwind, and additional complexity arises in determining what will happen to the timeshare upon your passing. What happens if I pass while […]

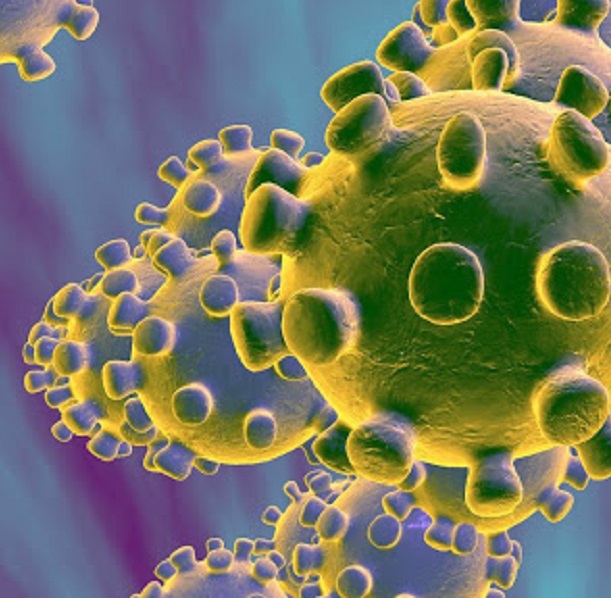

By now you know, on December 31, 2019, China reported a cluster of cases of pneumonia in people associated with the Huanan Seafood Wholesale Market in Wuhan, Hubei Province. A week later, Chinese health authorities confirmed that this cluster was associated with a novel coronavirus now identified as COVID-19. By January 30, 2020, a total […]