As we move ever closer to November 3rd, the 2020 presidential election is once again shaping up to be a polarizing event for our country. To top it off, the impacts of COVID-19 bring new challenges regarding the voting process and its integrity, due in part to an election that will involve the widespread use […]

It’s not necessary to do extraordinary things to get extraordinary results.” – Warren Buffett Since RTD’s founding in 1983, we have been inspired over the years by the generous passion of so many individuals and corporations who have been striving to make this a world a better place, not just for today but for generations to […]

The recent market volatility has brought the subject of behavioral finance back into focus. There are biases inherent in the human mind that affect a person’s ability to make sound decisions, whether they are related to an investment portfolio or everyday life. Over the coming quarters, I’ll be looking at a number of these biases […]

While timeshares can offer access to an exciting vacation destinations, they often lose their luster and benefits go underutilized. So, what happens when you want out? Unfortunately, timeshare contracts can be difficult to unwind, and additional complexity arises in determining what will happen to the timeshare upon your passing. What happens if I pass while […]

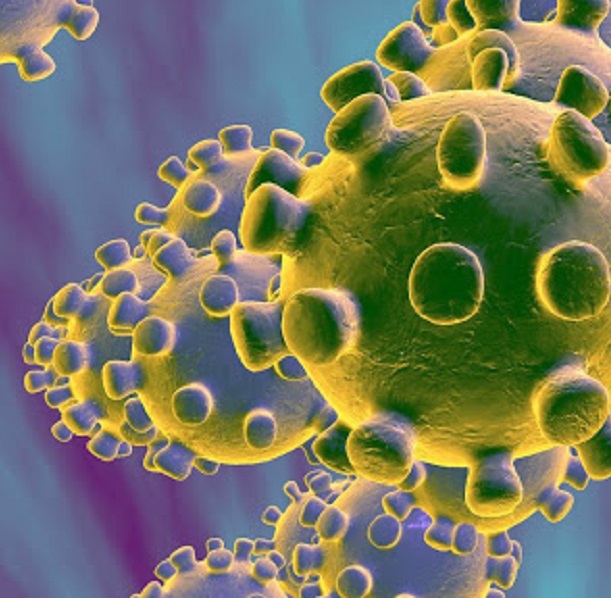

By now you know, on December 31, 2019, China reported a cluster of cases of pneumonia in people associated with the Huanan Seafood Wholesale Market in Wuhan, Hubei Province. A week later, Chinese health authorities confirmed that this cluster was associated with a novel coronavirus now identified as COVID-19. By January 30, 2020, a total […]

When building an investment portfolio, we often spend a lot of time on what specific asset classes will make up the “investment pie.” Determining the right mix of asset types, namely stocks and bonds, to help maximize profits while minimizing risk is what we refer to as Asset Allocation. The idea is to strike the […]

2018 will not go down as a great year in the investment world, as the volatility of the fourth quarter brought stock market losses across all major asset classes. Despite this, many actively managed mutual funds distributed significant taxable capital gains in December. This is the result of significant gains that have been building in these funds […]

It has become increasingly impossible to read or listen to any financial news lately that doesn’t include some discussion of tariffs. So, what are tariffs? Do they even matter? Tariffs are a tax or duty to be paid on a certain class of imports or exports. They are certainly not a new phenomenon as they […]

We hear a lot about China in the news. Some of it favorable and some of it not so good. Steel imports were the most recent topic, but the trade deficit, theft of technology, cost of doing business in China, currency manipulation, and the ownership of our government bonds continues to come up in the […]