Purchasing your first home can seem like an insurmountable task these days. Having a plan in place can help ease these thoughts and put in motion a way to accomplish this milestone. Here are five essential tips to help you navigate the process and make smart financial decisions as a first-time homebuyer: Save for a […]

Social media has a major influence on our lives, it is a source for communication, connection, and even how we make financial decisions when purchasing products. The rise of influencers on these platforms promoting products and posting their lavish lifestyle can have a significant impact on our own financial decisions. It is important as we […]

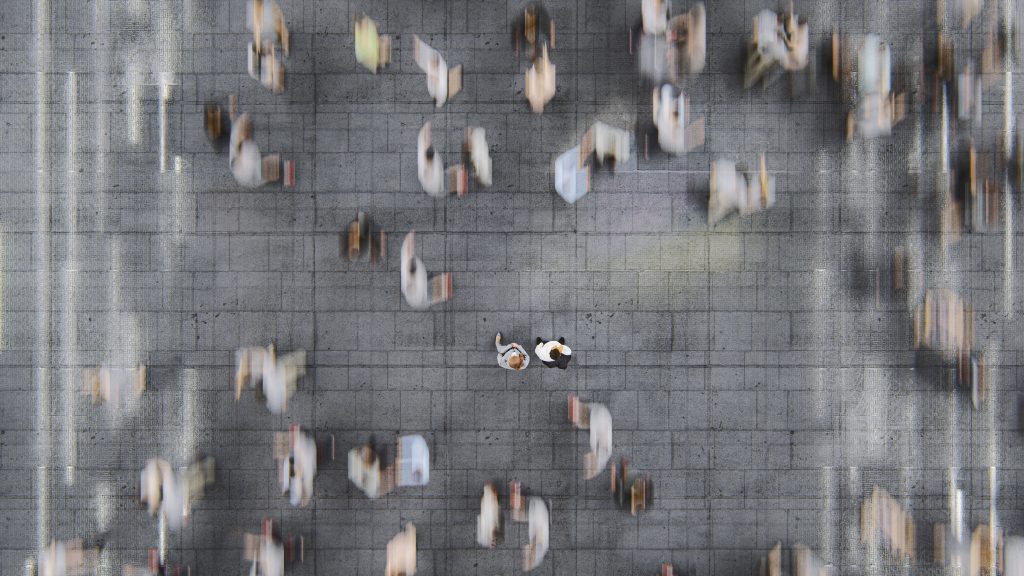

In a society dominated by cutting-edge technology and innumerable financial apps promising to simplify our lives, the role of a traditional financial planner may seem obsolete to some. However, as we navigate the complex landscape of personal finance, the human touch provided by a skilled financial planner remains indispensable. Here are several reasons why individuals […]

By instilling an understanding of money, budgeting, and investing early on, you can equip your children with vital skills that will serve them well throughout their lives. In this blog post, we will explore the positive aspects of teaching kids financial concepts and how it fosters a solid foundation for their future financial well-being. Building […]

Being a business owner comes with a long list of responsibilities and things to think about that extend far beyond the day-to-day operations of the business. Tax implications, insurance coverage, estate planning, are just a few of the issues that all business owners should be aware of and thinking about to maintain a healthy and […]

Shift the paradigm. Remove the mindset of “I make this amount, I spend this amount, and whatever is leftover I may get around to saving.” Focus on your life goals and make this shift: “I make this amount, I need to save this amount for my life goals, and I will spend what’s leftover (my […]

For both personal households and non-profit or for-profit organizations, the pandemic period of the past two years has brought great uncertainty as to its impact on respective income streams. The result for many has been a shift to the maximum safety of cash, money markets and similar vehicles, essentially leaving large amounts of assets sitting […]

Every investor and business owner should understand the concept of “piercing the corporate veil,” because in this instance, ignorance could be costly. When a company is established via a limited liability company (LLC) or incorporated as a C corporation or an S corporation, a distinct legal entity is created. Many of us are familiar with […]

Whether you’re pregnant, a new parent, or simply considering starting a family, there’s much to consider when planning for the arrival of a new baby. It’s no secret that kids are expensive, but with a little planning, you can feel confident and prepared for this big adventure! We’ve identified a few considerations below, broken out […]

We insure our cars, our homes, our lives, our collectibles, our livelihoods and our health. If we own high-end competition animals like race or show horses, we can also insure those animals – but should we insure pets as well? Pet insurance is now available from traditional insurance companies like Nationwide and GEICO, via agencies […]