For those of you old enough to remember the “Facts of Life” sitcom from the 1980s, you might remember part of the theme song that went:

“You take the good, you take the bad,

You take them both and there you have

The facts of life, the facts of life”

Well, if you replaced the word life with investing, those lyrics would ring true for investors. There are a lot of things that occur on a day-to-day basis in the markets that we could classify as good or bad. Sometimes, something we might think of as bad is perceived as good by the markets, and vice versa. And, a lot of the good and bad events occur very closely together, making it even more difficult for investors to only take the good and not the bad.

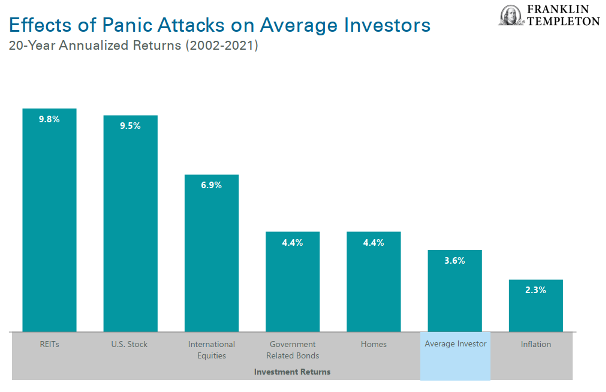

Reacting to events in the short run can result in disappointing returns in the long run. As the chart below shows, emotions get the better of the average investor. The performance in this chart is built taking into consideration the dollar flows in and out of mutual funds over a twenty-year period. So instead of an annual return of about 7% for a portfolio consisting of 60% equities and 40% bonds, the average investor only received returns of 3.6% per year. While this is a large difference, it gets even larger once the power of compounding takes hold.

Hypothetically, a million dollars invested 20 years ago and moved in and out of the market (like the average investor) would slightly more than double to $2.03 million. (1) In comparison, staying fully invested over that time in a 60% equity and 40% bond portfolio would’ve resulted in a 286% return with an ending value of $3.86 million. (2) That equals an additional 183% return (and $1.83 million dollars on our hypothetical $1 million dollar investment) by remaining fully invested in a diversified portfolio.

And just as a reminder, those returns were generated through a period that included the end of the Tech Bubble selloff in 2002, the Great Financial Crisis in 2007 through 2009, and a global pande

mic in 2020. In fact, the equity market lost nearly half its value during the Great Financial Crisis and over a third of its value during the global pandemic. Plus, the markets experienced pullbacks of greater than 10% in nine of the remaining years. Talk about bad.

But, then again, during these 20 years the US equity markets posted five years of returns greater than 20% and another seven years of returns between 10% and 20%. That equals 12 years (or 60% of the 20) of returns above the market’s long-term average of about 10%. That’s a lot of good.

Therefore, investors must stick to their financial plan, stay diversified, remain fully invested, and keep calm during trying times to reap the benefits of long-term compounding. In doing so, they must be prepared to take the bad with the good. Those are the facts of investing.

(1) This is a hypothetical portfolio for illustrative purposes only. The returns of the average investor portfolio assume $1 million invested from the beginning of 2002 through the end of 2021. Returns are compounded annually at 3.6% per year, assume no transaction fees, and assume fees and taxes paid from outside sources.

(2) This is a hypothetical portfolio for illustrative purposes only. The returns of the 60% equity/40% fixed income portfolio assume $1 million invested from the beginning of 2002 through the end of 2021. The portfolio composition is assumed to be 42% US stock, 18% international equities, and 40% government-related bonds and is rebalanced annually. Returns are compounded annually at 6.99% per year, assume no transaction fees, and assume fees and taxes paid from outside sources.