Mind the Gap

The phrase “Mind the Gap” was first introduced in 1968 on the London Underground in the United Kingdom. It is an audible or visual warning phrase issued to rail passengers to take caution while crossing the spatial gap between the train doorway and the station platform edge. The warning is meant to prevent potential serious bodily injury to travelers.

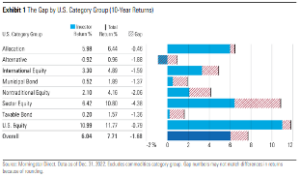

Morningstar recently published their annual “Mind the Gap” report, which also is meant to prevent potential serious injury. But in their case, the injury they are attempting to prevent is to investors’ long-term returns. The report compares the total returns of mutual funds and exchange-traded funds to the dollar-weighted returns of the funds (also known as investor returns). The gap between these two numbers quantifies the results of market timing decisions by investors. A positive number denotes investors were able to garner greater returns by making good market timing decisions and a negative number represents the opposite. Unsurprisingly, the ten-year return gaps for major fund categories as of the end of 2022 were all negative.

What is more shocking is the magnitude of the gap. Over the period measured, the investor returns were 6.04% per year compared to total returns of 7.71%. So, the cost of poor timing decisions by investors was about 1.7% per year. While that might not seem a lot, when compounded for ten years it resulted in a 30% difference in portfolio value. The discrepancy is even greater when looking at just sector funds. Investors’ attempts to predict which economic sectors would perform well at any given time in the past ten years resulted in a gap of 4.4%. Overall, none of the nine categories in the study showed positive gaps. These gaps are consistent with previous years of the report, which shows this is not a new phenomenon.

For the long-term, goal-focused investor, this report should be good news. It means their focus on “time in the market” is more beneficial to their long-term investing success than “timing the market”. Since, as they know, the only time to change the mix of investments in their portfolio is when there is a change to their investing goals and not in a futile attempt to chase returns.