We espouse the belief that “Time in the Markets” is more important to long-term investment success than “Timing the Markets.” “Time in the Markets” requires investing in a portfolio diversified in a number of ways: stocks and bonds, U.S. and non-U.S., large cap and small cap, and growth and value. “Timing the Markets” requires the ability to time the ups and downs of markets to maximize gains and minimize losses. We believe in diversification because we don’t believe anyone, including us, can time markets with any consistency or accuracy. In answering questions about the short-term future of markets, we’ll happily tell you “We don’t know” because it is the truth. We do not think there is any value is us pretending that we know the unknowable.

So, our goal is to keep your portfolio fully invested in a diverse mix of asset classes that have shown the ability to consistently produce returns over the long-term to support your financial plan. A well-diversified portfolio means that, at any given time, you will feel disappointed with the returns of a few asset classes, relative to others. We view that as a positive, because it gives us the opportunity to rebalance into out of favor asset classes, reducing the risk and enhancing the returns of the overall portfolio going forward.

The past two calendar years provided ample proof that diversification works. A lot of investors threw in the towel on Real Estate in 2020 as the asset class lost 9% in the face of uncertainty as the pandemic shut down the global economy. Twelve months on, Real Estate was the best performing asset class, returning 42% in 2021. Additionally, U.S. small cap value stocks trailed their growth peers by 30% in 2020, only to best them by almost 26% this past year. Finally, the allocation to Treasury Inflation-Protected Securities proved its worth as an inflation hedge over the past two calendar years, returning over 18% as inflation rose unexpectedly during the reopening of the global economy.

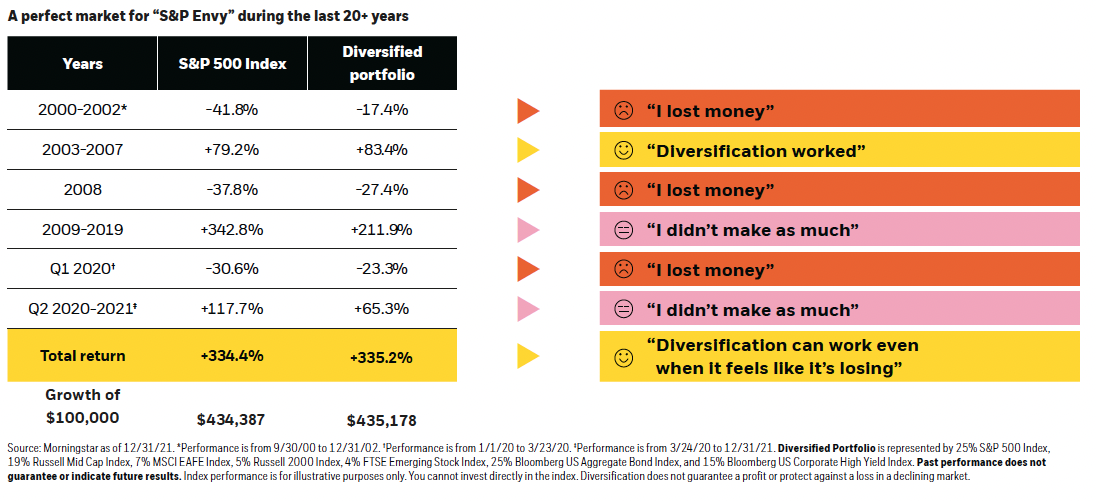

As noted above, a well-diversified portfolio doesn’t necessarily mean investors must sacrifice returns. As seen in the chart below, a diversified 60% equity and 40% bond portfolio actually outperformed the S&P 500 over the last 20 calendar years. While the diversified portfolio trailed in strong equity markets, its real benefit was that it declined less in down markets. As it turned out, picking up only 60% of both the positive and negative returns of the S&P 500 resulted in solid long-term performance, even as there were long stretches of time where it seemed diversification “wasn’t working”.

Without a disciplined, diversified approach to portfolio management, some of those returns may have been missed.